Golf, Tennis, Basketball, Volleyball, Soccer, Baseball, Taekwondo, Gymnastics

Welcome and thanks for visiting...

Saving for Youth Sports

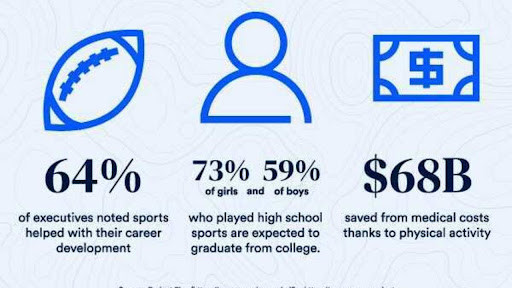

Youth sports can be excellent character-building activities for children. They instill teamwork, communication, and discipline, which can pay dividends later in life. Along with physical benefits, kids engaged in sports develop cognitive skills such as improved concentration and classroom behavior.

That said, participating in these activities often comes at a price. Sports can cost as low as $191.34 for track and field to $2,582.74 for ice hockey. Our guide on saving for youth sports will help you learn the costs and plan for those expenses before they become untenable for your finances.

Cost of youth sports

Costs vary depending on the sports your child does. Expenses can include participation fees, equipment, camps, private lessons, and travel. Travel, in particular, can be the most expensive cost when you factor in fuel or airfare, hotel, meals, and other items. Travel teams can cost $2,226 on average annually, according to Project Play, a research firm that tracks the participation and cost of youth sports across the country.

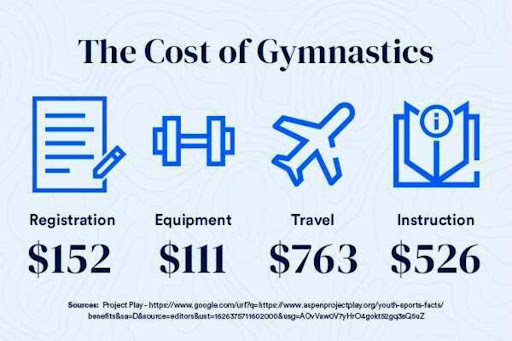

Project Play estimates parents will spend on average $692 per child per sport each year. This infographic breaks down the average costs of gymnastics to illustrate all the expenses associated with one sport with data from the Aspen Project. Their study also includes the average price of each sport here.

As you can imagine, failing to plan for these expenses ahead of time could make a significant impact on your budget. It is why incorporating costs into your budget ahead of time is a wise course of action.

How to fund youth sports

There are many ways you can fund your child’s sports. One of the most effective strategies is to open a savings account dedicated to sports expenses and contribute to it regularly throughout the year. When searching for a savings account, look for ones that offer higher savings rates, no minimum account balances, or monthly fees. Doing so allows you to maximize your savings without the bank chipping away at it.

Moreover, to keep your savings account growing, implement the “pay yourself first” strategy. Set up automatic transfers from your checking to your sports savings account on payday. Even if it is $10 every two weeks, that’s still $260 per year. And if you start early enough, you have a cushion as they try out different sports.

Another savings opportunity comes by way of travel rewards. If your child plans to play a sport where travel is required regularly, then it makes sense for you to earn rewards for expenses you were going to have. With travel credit cards, you can gain higher cash back incentives for hotel stays, rental cars, flights, and dining. You can also accumulate points you could use for free hotel stays, discounts on flights, and more.

Keep in mind the rewards are most effective if you pay off the balances every month. That way, you earn the cash back incentives without the interest fees. Some cards also offer a low introductory rate, where you could pay 0% APR for the first year. Therefore, if you need to carry a balance for a few months, it allows you to do so.

Furthermore, there are other ways to save money on youth sports. You could check to see if there are fundraising opportunities–some teams hold them to offset the cost of participation fees and equipment.

There might be low-income or free options as well. Organizations like Every Kid Sports and the Kids Play USA Foundation work with low-income families, providing them with resources so their kids can play. You can also check with local organizations like the YMCA, church and civic group for aid opportunities.

Meanwhile, if your child is old enough, they could get a job to help save money for their sport. Washing cars, mowing lawns, or working in retail could be a wise way for them to learn more about the value of money while also incentivizing them to play a sport.

Reducing the costs of youth sports

Even with fundraising and lower-cost options, you’ll still likely have to pay some out-of-pocket expenses for youth sports. However, knowing the costs ahead of time gives you room to prepare for them.

It also provides you with an opportunity to be creative about reducing costs. One of the best ways to do this is to buy used sports equipment. In many sports, the equipment can be one of the highest costs, so purchasing used items lowers your expenses. You can use Facebook Marketplace, Craigslist, or retailers like Play It Again Sports to find them.

Also, as parents, you could pool your resources together to save money. Carpooling kids to local games or receiving a group hotel rate for bigger parties can reduce fuel and travel expenses. Lower costs more by having each parent take turns providing snacks or meals during tournaments.

You could also see if there are volunteer opportunities available within the sports organization. By volunteering, you could reduce or eliminate the participation fee.

On the fee front, you also want to register as early as possible for games or tournaments. Many organizations offer discounts when you register teams early.

And if travel costs are a concern, see if there are local teams available. It would eliminate those expenses while allowing your child to play.

Establishing a budget

On the budgeting end, you want to factor in all costs upfront. They can include participation fees, camps, uniforms, equipment, travel fees, and more. Doing this gives you a more accurate depiction of how much you need to save. Then, you can add these expenses to set a savings goal.

Keep in mind costs can arise at different times throughout the season. To demonstrate, if your child participates in baseball, they might have baseball lessons before the season starts in which case you would need equipment too. Then, as the season approaches, you’ll pay for the registration, camps, and other applicable fees. If your child’s team travels, you’ll receive a schedule of the times when they go on the road.

Anticipating these expenses for different times of the season can help your family ensure you have the money to pay for these costs. Moreover, by budgeting how much wiggle room you have for sports, it could also help you determine which ones are financially feasible for your family.

Bottom line

Youth sports can be expensive for families. However, by understanding all the costs upfront, you can budget or find low-cost alternatives to keep them from taking a chunk out of your finances.

Blog written by Sean Jackson.